ATX™ 2019

Depreciation and Section 179 Tab

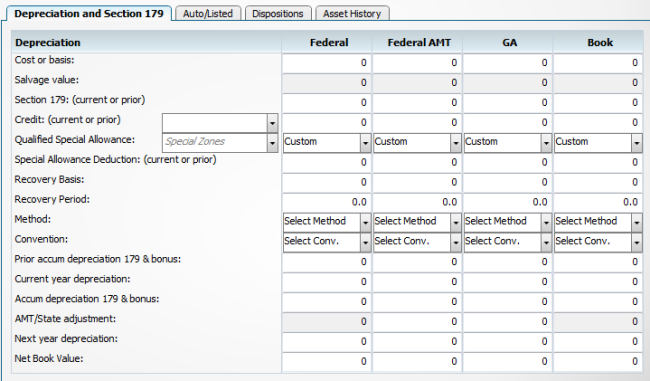

After the main asset pane has been completed, this tab allows for entry of the asset’s Cost or Basis in order to calculate the depreciation of the asset.

To enter depreciation:

- Enter the Cost or Basis of the asset in the Federal column. Entering the cost or basis in the Federal column also completes the cost in the Federal AMT and State columns.

- The Fixed Assets form calculates the following based on this entry:

- The recovery period, method, and convention for the Federal, AMT, State, and Book columns if a category/subcategory was selected

- Any qualified Bonus depreciation

- The Recovery Basis

- Prior depreciation (if this is a prior year asset)

- Current year depreciation

- Accumulated depreciation

- Next year depreciation

- Enter any other applicable information in the space provided.

Depreciation and Section 179 tab on the Fixed Assets form

The calculated entries can be changed if necessary by selecting the field and entering the changes. The text of the overridden fields will be red. To restore the calculated field, right-click in the field and select Restore.

See Also: